I was driving with my granddaughter when she unexpectedly asked me how much a Tesla cost. I could have answered, “about a hundred thousand dollars,” but before I spoke, realized this would miss her point. She is seven years old and a hundred thousand dollars is a meaningless concept to her. More to her question would be, “how much does a Tesla cost compared to another car.” Answering that a Tesla costs about twice the price of “that car over there,” would still miss her point and I would have lost an educational opportunity. As my mind raced to find an answer I found myself asking a lot of questions; how long does the battery last, what’s the cost of its replacement, how much money will I save in fuel, how much does it cost in electricity to charge the car… when my granddaughter said, “its ok granddada if you don’t know the answer.”

Although we talked later, she probably still isn’t fully satisfied with my response. I, on the other hand, learned a valuable lesson. Evaluating how much something really costs, especially if it is unique and different from our experience, is infinitely more complicated than focusing on the upfront purchase price.

The Status Quo

The status quo in the building industry is to evaluate building projects almost completely on upfront costs, expressed in dollars per square foot. This approach has some validity when comparing buildings that have similar operating costs and performance but are inadequate when comparing projects that don’t. To address those cases, a Life Cycle Cost Analysis, (LCCA) is the best method and the one approved by the federal government and the army corps of engineers. As an example, imagine the task of comparing two dam proposals. One, an earth dam with low upfront costs, high maintenance expenses and total replacement every 25 years. The other, a concrete arch dam with large upfront costs, low maintenance and a 200-year life. An LCCA will enable the Army Corps to make an un-biased economic assessment, giving them the financial information, they need to guide their decision.

At the Stasis Building company, we are frequently asked, “what is the cost of the Energy Mass™wall system?” Knowing the person asking the question has the $15.00 per square foot published cost for an insulated metal panel in mind, and that the energy Mass Wall includes (i) the building’s structure, (ii) its mechanical system, (iii) a four-hour fire wall, (iv) an insulative value greater than the walls of a Sub-Zero refrigerator… we face the same dilemma I was confronted with by my granddaughter’s Tesla question. The only correct response is; “to effectively answer your question, we need to gather some information about your business and then run an LCCA comparing the Energy Mass™Smart Building Technology with other alternatives you may be considering.”

A Life Cycle Cost Analysis (LCCA) Produces an Unbiased Assessment

Stasis uses the Federal government (DOE) approved template and algorithms to prepare an LCCA for its potential clients, producing a fair unbiased financial assessment. The analysis will show which projects will benefit economically and what the expected pay back times will be. It will also show which projects will either reap no financial reward or will have extremely long payback periods.

The most straightforward LCCA, which is the easiest to understand, makes three assumptions. First, it assumes the upfront funding required to pay the cost difference is supplied by the owner without interest costs, secondly that the cost of energy is unchanging throughout the payback period (a conservative assumption), and thirdly dollars are not converted to their “present value.” If the LCCA thus prepared is favorable, a follow up LCCA can be run which addresses the above assumptions. For instance, if the owner is planning to borrow the funding required for the additional upfront costs, then the interest and terms of the loan can be rolled into the LCCA.

Conduct an Energy Mass™ Wall Life Cycle Analysis

Comparing Upfront Investment with Annual Operating Expenses

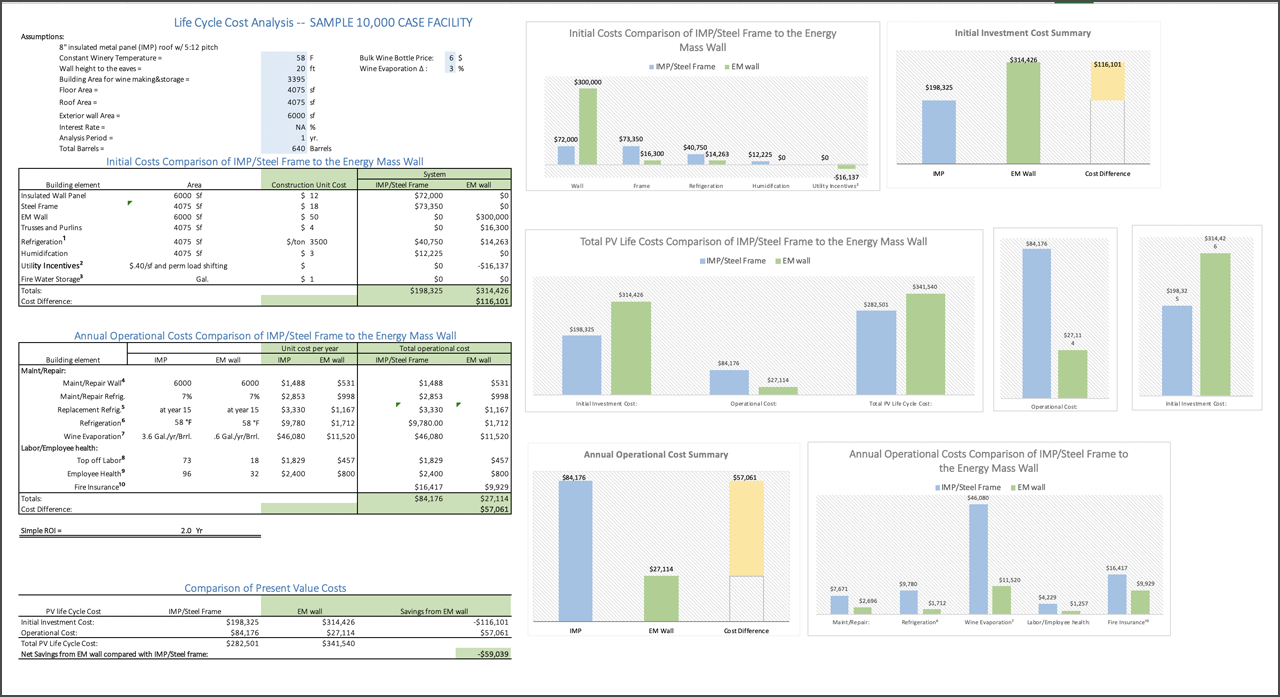

To perform the basic LCCA two categories of information are dissected. The first is a comparison of initial costs or upfront capital investment. In the case of Stasis Building’s Energy Mass™smart building technology; construction material and labor costs are compared against either a baseline building system such as a pre-engineered steel frame covered with insulated metal panels (IMP), or some other construction system which the owner is considering. The analysis will include not only the construction costs of the buildings but also the costs of the mechanical, humidification and fire water systems as well as utility company incentives and rebates for energy efficiency. The net totals result in an upfront cost difference, which is the additional funds the owner would need to supply at the initiation of the construction.

The second category compares the annual operating expenses which includes non-escalated electrical charges, fire and earthquake insurance, the costs of maintenance, repair and replacement of the facility and necessary components including the refrigeration systems. It also includes the costs of wine evaporation from barrels, based on owner supplied values.

Specific information required to run an analysis on a winery project includes the volume of conditioned space in the barrel room, the total number of barrels, and an estimate of the amount and value of the wine used to top-off the barrels during aging.

The result of the LCCA is conveyed as a return on investment (ROI) which is expressed in the years and months it takes for the savings in operational expenses to payback the upfront cost difference. If the analysis of the basic LCCA results in an acceptable payback time then a refined analysis can be performed to account for interest charges and expectedenergy cost escalation.

It is difficult to predict the outcomes a priori as it is sensitive to climate zones, electrical time of use charges, evaporation and value of top-off wine. That said; however, we have seen barrel storage projects with ROI’s under three years and cold storage projects less than six years. In many of these cases, the entire cost of the building is paid off in advance of the final mortgage payment.

That would be like buying a Tesla for $100,000 and saving $100,000 in operating costs before the final loan payment is made five years later.